coeo

Visiting address

Bankstrasse 4

8610

Uster

Postal address

Bankstrasse 4

Uster , 8610

Contact person

Barna BokorCompany information

Customer Centricity meets AI

At coeo, customer satisfaction is not merely a goal – it is our core mission. We are much more than a traditional debt collection service provider. Our approach encompasses more than just settling claims. Our priority is to harmonise customer relationships for the long term in the most convenient and efficient way possible. To do this, we use cutting-edge AI-based processes and insights derived from behavioural research. These are perfectly complemented by the extraordinary expertise of our customer service employees. This innovative combination not only makes us a beacon in the industry, but also Europe’s fastest-growing technology-based debt collection company.

Why coeo?

- BNPL market leader with over 5 million claims.

- Innovation-driven customer orientation for tailored debt collection solutions.

- International presence, currently with our own facilities in seven European countries.

- Capacity and competence of a large corporation complemented by the flexibility of a medium-sized company and the spirit of a fintech start-up.

- Superior success rates driven by a robust tech stack, an extensive data pool and continuous performance management.

- Exceptional employees with valuable expertise and an unparalleled team culture.

- Over 80% customer satisfaction and a Google rating of 4.5 stars speak for themselves.

Technology

We ensure the right balance - pioneering technology-driven, AI-based & still close to the customer.

Customer centricity meets AI

As a driver in the industry, we rely on AI-supported processes developed in-house that provide our employees with the right support at every step of the process and increasingly finalise cases in just a few seconds. This is made possible by the use of our modular AI ecosystem ‘cAI’. cAI is revolutionising receivables management and, with its extensive modules based on generative AI, is taking coeo's customer service and process efficiency to a new level.

cAI Technology - unlocking even more AI power

The cAI Technology GmbH is now an independent company, fully focused on developing and deploying intelligent AI solutions. With over 1 million customer interactions and an automation rate of over 50%, cAI is already revolutionizing customer communication.

The cAI Technology GmbH is now an independent company, fully focused on developing and deploying intelligent AI solutions. With over 1 million customer interactions and an automation rate of over 50%, cAI is already revolutionizing customer communication.

As part of the coeo Group, cAI remains closely connected to coeo’s processes – allowing innovations to be tested and refined quickly and efficiently in real-world applications. At the same time, its independence enables an even more agile response to new technological developments.

Learn more on the new cAI website.

The future is cAI

The game changer: our modular AI ecosystem cAI ensures the intelligent continuation of our clients' customer journey and optimises the return of consumers after a successful debt collection procedure. cAI supports all of coeo's business processes and operates with maximum flexibility in terms of target groups and specifications in its individual modules.

With a total of ten modules such as Text and Voice Agents, Decision Navigator, Quality Sentinel and Fraud Detector, cAI not only ensures improved accessibility and responses in real time, but also maximises quality and reputation protection for our clients.

Company information

8610 Uster

Switzerland

Solutions

- AI-Based Debt Collection

- Consumer-Centric Debt Collection

- Debt Collection

- Parking Debt Collection

- Smart Debt Collection

Product information

Experience

Innovation driver for an entire industry. 100% smart debt collection - customized, service-oriented and intuitive.

We create the right balance

Our data-driven debt collection strategy and innovative use of AI are establishing new benchmarks in the industry. Our synergistic combination of state-of-the-art technology and human expertise not only achieves the near-automatic settlement of claims, but also creates lasting equilibrium in your business relationships.

Our data-driven debt collection strategy and innovative use of AI are establishing new benchmarks in the industry. Our synergistic combination of state-of-the-art technology and human expertise not only achieves the near-automatic settlement of claims, but also creates lasting equilibrium in your business relationships.

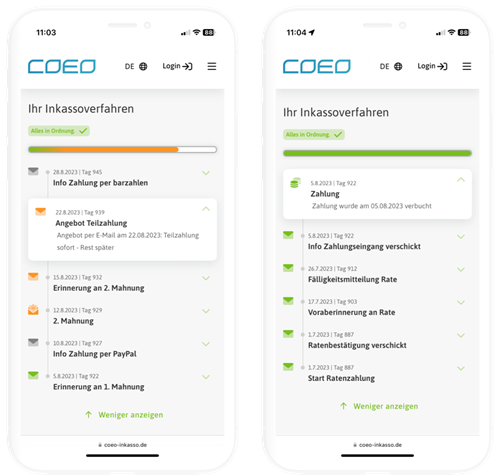

Precise collection at all contact points!

Our method is built around self-learning processes that adapt to the behaviour of consumers. The system recognises how they communicate and draws conclusions on how best to respond. For instance, aspects such as tonality, communication channel and payment are selected individually throughout the personal customer journey. This includes all standard digital channels, in addition to the usual methods such as phone calls and written correspondence. The result: settled claims and a relaxed customer!

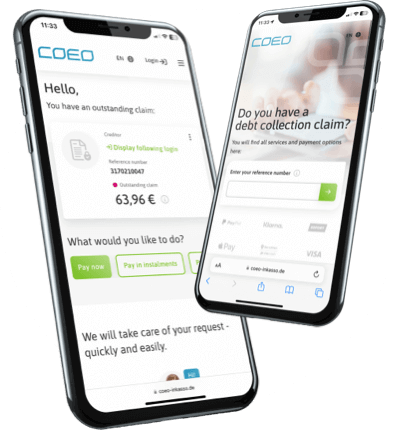

Best service portal: Superlative customer service

Best service portal: Superlative customer service

Tailored, service-oriented, intuitive: Your customers can access a portfolio of services on our service portal that is unrivalled elsewhere in the industry. Settling outstanding claims could not be easier or faster. See for yourself!

Sustainability management

We aren’t only about debt collection – we do much more than that. Our sustainability management reflects what we believe and how we shape the future.

Our strategy

Holistic sustainability strategy

We pursue a comprehensive sustainability strategy that is oriented not only towards financial returns, but also long-term viability and responsible business practices. From the planning of our business processes to innovative IT solutions, there is an element of sustainability integrated into everything we do.

Stakeholder involvement and dialogue

We seek active dialogue with our stakeholders, participate in sustainability initiatives and swap ideas and information with industry associations. This holistic approach takes all interests into account and enables us to respond appropriately to feedback.