Monit: Parking and The ‘New Normal’ – a Data Analysis

After more than 1.5 years of living with Covid-related measures in the Netherlands, the 1.5 meters social distancing rule was abolished at the end of September. Life returned to the ‘old normal’ and the situation looked on the up for a while. We now know (early-December) that this was premature.

How we deal with this kind of change varies from person to person. For example, behavioral psychologist Sabine Jansen indicated in an article (Dutch) in De Stentor that not all noses are pointing in the same direction, but that it will probably all be okay in the end when the old life returns. The expectation is that much of life will become as it was before. However, crises can also act as a trigger for permanent changes in human behaviour. For example, Covid has ensured that working from home has become more normal and our parking behavior has changed with it. The question is whether these changes are temporary or permanent. Using the data-driven insights into parking trends from Monit Data’s Parking Monitor, we can answer this question.

Big consequences

If these changes are permanent, this will have consequences for society and the environment. For example, it is likely that the need for office space will remain lower, because a ‘hybrid’ working from home model has become normal. If we go to the office less often, the car will be parked at your home’s front door more. We also have more of our groceries delivered at home. Parking pressure and parking behavior at offices and shops are therefore decreasing, and increasing at homes. Or could it be the case that in the long run car ownership will decrease because we work and shop more from home?

We must monitor these shifts in order to use the right amount of (public) space for parking cars. Not more than necessary, because that space is becoming increasingly scarce in many places. That requires choices; do we turn it into parking or living space? Or space for limiting heat stress, or for water storage? This also applies to new developments where we want to make a correct estimate of the required number of parking spaces. Parking space codes can change permanently due to Covid. This also applies to our existing insights into the interchangeability of parking spaces between multiple target groups (the so-called ‘double use’).

But now back to the present for a moment. Human movements can be easily mapped out by analyzing parking trends. By regularly analyzing how many parking transactions, with what duration, at which locations and by which user group, it is possible to see that parking trends are changing.

Google Mobility Index

A first indication that this change is permanent can be obtained from the Google Mobility Index (GMI). In this, index it is analyzed on the basis of movements of mobile telephones when people are where and for what purpose. Can parking data further substantiate and even refine these indications?

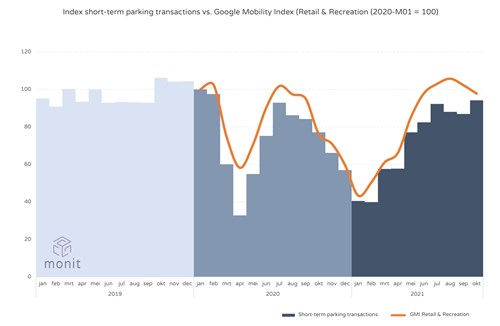

For this, the GMI Retail & Recreation was compared with the parking trends for short-term parkers. These are visitors who pay for parking at a time. From an anonymised dataset of municipalities using the Monit Parking Monitor, we can conclude that there appear to be no permanent changes among short-term parkers. When the measures are eased up, we see that parking trends quickly return to the situation before Covid (Figure 1). The trends are similar to the pattern in GMI Retail & Recreation.

The monthly index value (January 2020=100) of the GMI Retail & recreation (orange lines) and the index of the total number of hours that short-term parkers have parked (Parking monitor figures).

To be able to make a comparison with the situation before Corona, the short-term parking index starts in January 2019. The month of April 2020 shows the strongest negative value of the short-term parking index (32.7). So 67.3% fewer parking hours were sold to short-term parkers compared to January 2020. The index value was 93.4 in April 2019.

In addition, we see that the GMI Retail & recreation, with the exception of October 2020, remains structurally above the short-term parking index. This means that if we move less to retail and recreational locations, the effects for parking will be more visible.

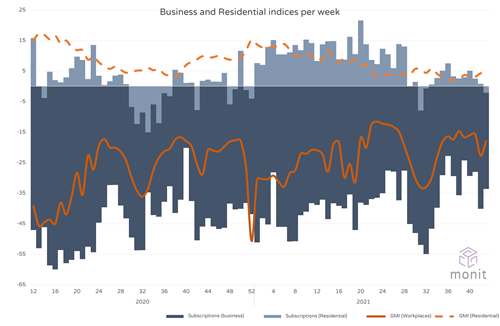

Short-term parking behavior will therefore probably not change permanently. The GMI Workplaces and GMI Residential seem to confirm that the trends between residential and work locations is strongly related (see figure 2). An increase in the Residential GMI is accompanied by a decrease in the Workplaces GMI. If we stay at home more, we travel less to the office. To investigate whether this is permanent, we analyzed how the parking trends of subscription holders, subdivided into residents and business, is changing.

The changes for resident subscriptions trends and GMI Residential are limited. Both are mostly positive. With the GMI this is continuous and the Residents Index trend too with the exception of the summer months. It is possible that the car was used more often during the holiday period to go out. After easing of the measures, both indices seem to go to 0.

The effects are more apparent with business indices. Both the GMI Workplaces and Subscription Index trend show strongly negative values throughout the period. So we are less at work locations. In addition, the Subscription Index trend has fallen much faster than the GMI and the dependency relationship with the Residents Index trend is not 1-to-1. It appears the values are no longer close to 0 and this seems to be a permanent change. Working from home has become the new normal.

The change in the weekly GMI Residential, GMI Workplaces (orange lines) and the index of the total number of hours that residents (light blue) and business subscriptions (dark blue) have parked in 22 parking garages spread over 5 municipalities in the Netherlands. This change is calculated relative to the median value from weeks 2 to 6 in 2020.

Covid measures show a limited increase in the GMI Residential and resident subscription index. Both the GMI Workplaces and the business subscriptions show a negative trend. With the exception of weeks 1 and 4 in 2021, the business parking index is declining more than you would expect based on the GMI.

The need for further research

The urgency of more research is immediately apparent in this article. The use of parking spaces at offices and homes is changing. If this is permanent, then ‘rules of the game’ in our parking industry will need to be reconsidered and adjusted.

Conclusion

Parking trends have deviated from the normal in the past 1.5 years. In part, this appears to be permanent. When Covid measures are lifted, the parking trends for short-term parking will hardly change. However, if we look at business parking, a trend can be discerned that could well be permanent. We must continue to monitor to verify this hypothesis.

About Parking Monitor by Monit Data

Optimize the management and policy of your parking facilities with the Parking Monitor from Monit Data. Making the right decisions based on the massive volume of data generated by modern parking equipment is a challenge. Monit Data converts this data into clear insights for you. For on- and off-street and EV. Don’t spend unnecessary time on manual collection using our automatic connections with equipment suppliers, scan-cars and EV charging points.

About Monit Data

.png) Monit Data provides parking data analytics services for municipalities and private operators. User-friendly dashboards give clear information on car, EV and bicycle usage. Use data-driven insights for urban mobility policies and day-to-day operational management.

Monit Data provides parking data analytics services for municipalities and private operators. User-friendly dashboards give clear information on car, EV and bicycle usage. Use data-driven insights for urban mobility policies and day-to-day operational management.

Comments

There are no comments yet for this item

Join the discussion