CCV: Why PIN Entry Matters for UK EV Charging

As the UK transitions to a future dominated by electric vehicles (EVs), the demand for seamless and secure payment solutions at EV charging stations has never been more important.

Imagine this scenario: you’re a business traveler meeting with your customers, and you stop at a charging station to top up your EV-battery. You present your debit/credit card, and the terminal declines the transaction. Frustrated, you move to the next charger only to face the same issue. What you don’t realize is that your card issuer has requested a PIN entry to authorize the payment, but the terminal doesn’t support PIN-confirmation and only shows that the card has been declined.

The absence of a PIN entry option isn’t just an inconvenience — it can halt charging transactions entirely, damaging user trust in you as an operator or public EV-charging in general. Fortunately, this problem can be solved.

UK Market Context & Regulatory Pressures

While paying becomes easier with innovations like contactless and smartphone payments, security remains a priority. One of these security measures implemented by card issuers is to request PIN confirmation after several payments or when exceeding specific amounts. For instance, if a transaction exceeds £100 or if the card has accumulated £300 in contactless spending since its last PIN entry, a PIN is required.

However, many early charging stations were deployed with terminals lacking the ability to handle PIN requests, under the expectation that classification under a Merchant Category Code (MCC) similar to parking systems would exempt these from such requirement. This exemption, under the Second Payment Services Directive, was however never clarified.

The result? Many charging stations feature contactless-only terminals, which can’t meet the needs of all customers. Consequently, more and more operators report that a significant number of the plastic cards presented are rejected due to a missing PIN entry. With increasing transaction values and security measures, PIN-entry is now crucial for ensuring EV charging payments are processed smoothly and securely.

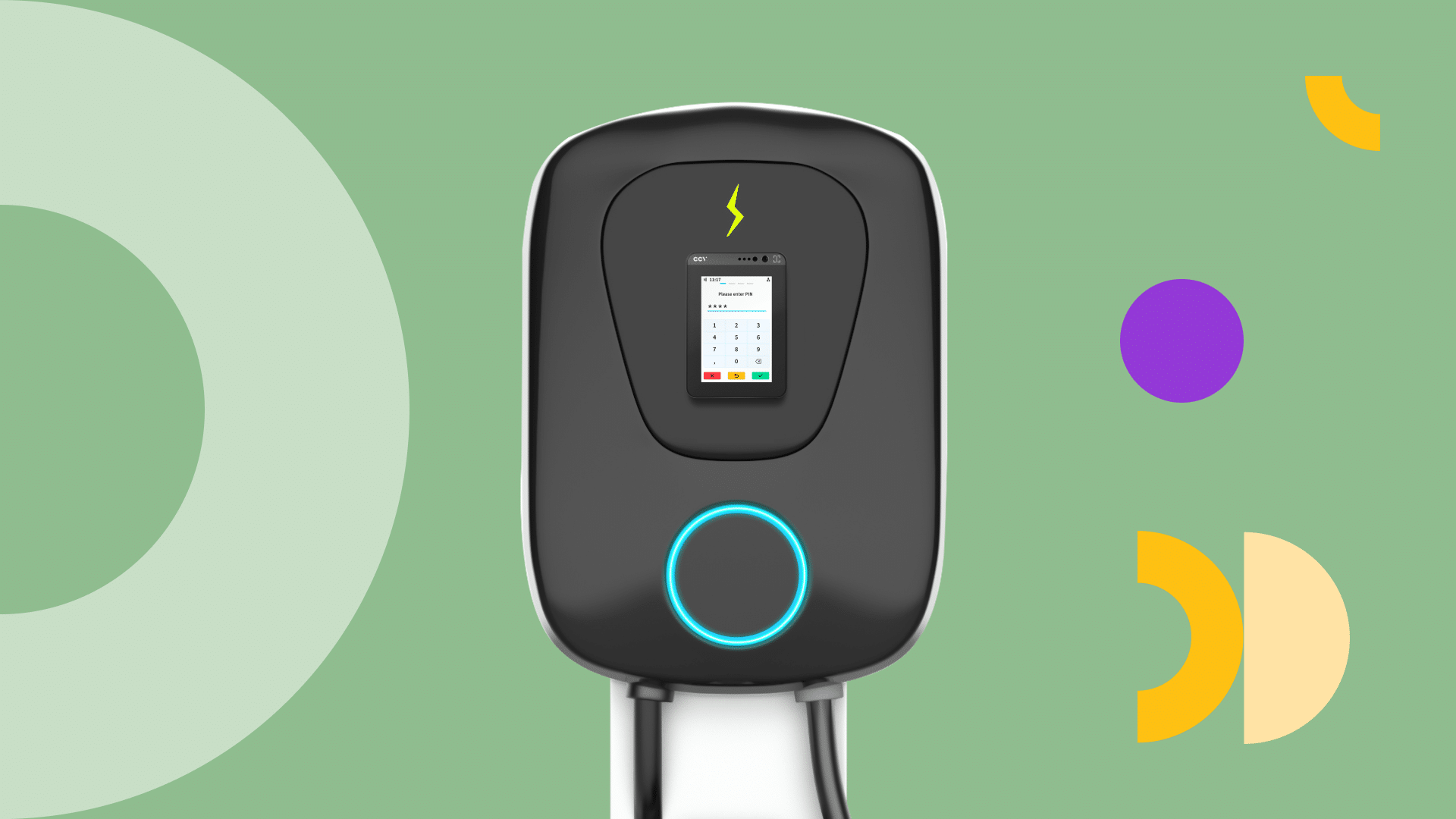

The Solution: PIN-on-Glass with CCV IM15 Series and IM30

To meet this growing demand, CCV’s payment terminals provide a bright, intuitive touchscreen for PIN-on-glass entry — meaning the customer can enter their PIN directly on the screen, without the need for additional mechanical PIN pads. This allows for efficient use of the payment terminal for full-screen information sharing while still offering PIN-entry.

|

|

CCV’s payment terminals are perfect for both new installations and for retrofitting existing charging stations, providing a future-proof way to meet both regulatory standards and customer expectations. Key features include:

- Compact Design: The CCV IM15 series offers multiple installation options — whether front-mounted (Edge IM15) or flush-mounted (Frame IM15) — making it ideal for both new and retrofit projects without compromising on the aesthetics of your charging station or payment kiosk design.

- Multi-Payment Support: These terminals enable contactless payments and handle more complex PIN-on-glass transactions, ensuring compliance with card issuer requirements. This significantly improves card acceptance rates. With the IM30 you can expand this further with chip-card and magstripe payments.

- Clear User Guidance: The large touchscreens make it easy for drivers to follow and control the entire payment process.

- Elavon Acquiring Certification: Our expanding partnership with Elavon ensures robust payment support for a wide range of transactions.

Why CPOs and CPMS Providers Should Care

For CPOs and CPMS providers, ensuring that every customer can pay easily and securely is critical. The inability to process PIN-required transactions can lead to lost revenue, frustrated drivers, and damaged brand trust. By making use of the CCV IM30 and IM15 series terminals, operators can enhance the customer experience, improve compliance with UK payment regulations, and avoid the need for bulky hardware installations.

About CCV

CCV is an international payment solutions provider that services over 600,000 businesses with end-to-end payment solutions in Europe. Our extensive portfolio includes a processing and settlement platform, online and closed-loop payments, acquiring services, and a wide range of in-store and unattended payment terminals. CCV’s focused partnership strategy, as well as direct SME offerings, enabled us to take leading positions in all home markets: the Netherlands (HQ), Germany, Belgium, and Switzerland. Our success is based on innovation and a long-term customer-focused commitment via partnerships and SME businesses.

CCV is an international payment solutions provider that services over 600,000 businesses with end-to-end payment solutions in Europe. Our extensive portfolio includes a processing and settlement platform, online and closed-loop payments, acquiring services, and a wide range of in-store and unattended payment terminals. CCV’s focused partnership strategy, as well as direct SME offerings, enabled us to take leading positions in all home markets: the Netherlands (HQ), Germany, Belgium, and Switzerland. Our success is based on innovation and a long-term customer-focused commitment via partnerships and SME businesses.

Comments

There are no comments yet for this item

Join the discussion